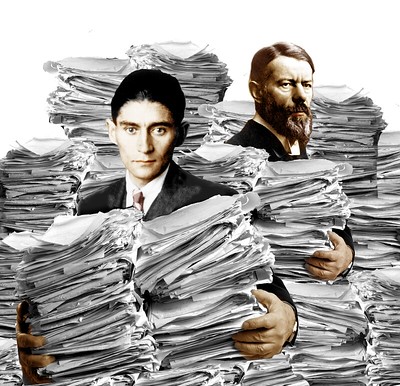

How not to digitise property transfer bureaucracy

Spanish property-buying bureaucracy (title registration and payment of local and regional taxes) is a wonderful example of how NOT to digitise government processes. It tries to mirror the previous paper-based atrocious bureaucracy, and ends up unusuably complex… rather than taking advantage of technology to streamline the whole process. (I already gave up trying to use the regional tax agency’s online system.)

The public official (notary) who must draw up and witness the signature of the sale contract then electronically pre-notifies the land registry and local council of the details ✅ and yet… the regional tax agency cannot supply a bank account number and reference (and ideally a payment instruction that could be taken to any bank) to enable the transfer tax to be paid. Instead, you need an account with one of the few Spanish banks that supports tax payments ??♂️ So much for the Single European Payment Area, let alone the single market @DigitalEU (I mainly use @RevolutApp.)

You also need to physically take a paper receipt from the bank to the tax agency, queue, have them check the receipt, then stamp your sale contract ? Then you queue at a DIFFERENT office (the land registry) to start the process of transferring the title. THEN you pick up the sale contract with extra stamps several weeks later. (Spanish bureaucrats LOVE stamps.) This whole thing would give @JerryFI and @williamheath nightmares.

How people with full-time jobs and/or caring responsibilities manage this, I have no idea. I usually set aside an entire day (this took two) per government interaction. I can only be grateful the weather is good to queue outside. This is after a YEAR of ?!

UPDATE: @X_net_ asked: we are activists in Spain and are working on this issue. Could you tell us an EU Member State that could be an example of good practice? I replied: Hi! Good question. I have only otherwise lived in the UK. The advantage there is interaction with government sites is generally much simpler (which is appropriate given the genuine security requirements for most interactions.) In general you simply register with an e-mail address and some info you and the government know but others are less likely to. In some higher-security cases (eg medical or tax) you can get an additional password by post or when you visit your doctor to enable access to confidential information (such as your medical/tax records). So the key is to assess the actual security risk of these processes then design appropriate security mechanisms, rather than having a very slick eID process.

@ntouk added: Yes, exactly that: “What’s the problem you’re trying to solve?” 🙂 All too often it seems back-to-front: outdated, tech-centric ‘solutions’ to perceived needs rather than actual security risks. And SSO & ‘identity’ repeatedly get unnecessarily forced together. We only use credit/debit cards when we need to authorise payment—similarly, we should only need to use ‘trusted ID’ on those rare occasions when we’re obliged legally to prove something about ourselves (e.g. ‘Over 18’ when buying alcohol or knives). User-controlled smartphone apps (as with the emerging ICAO DTCs/ISO MdLs) enable selective disclosure of trusted identity/data when required. Arbitrary requirements for ‘strong ID’ when it isn’t required, or bound to SSO for no good reason, seems to be part of another agenda…